Wow. Talk about discouraging news first thing in the morning.

GOBankingRates is reporting that nearly 7 in 10 Americans have less than $1,000 in savings.

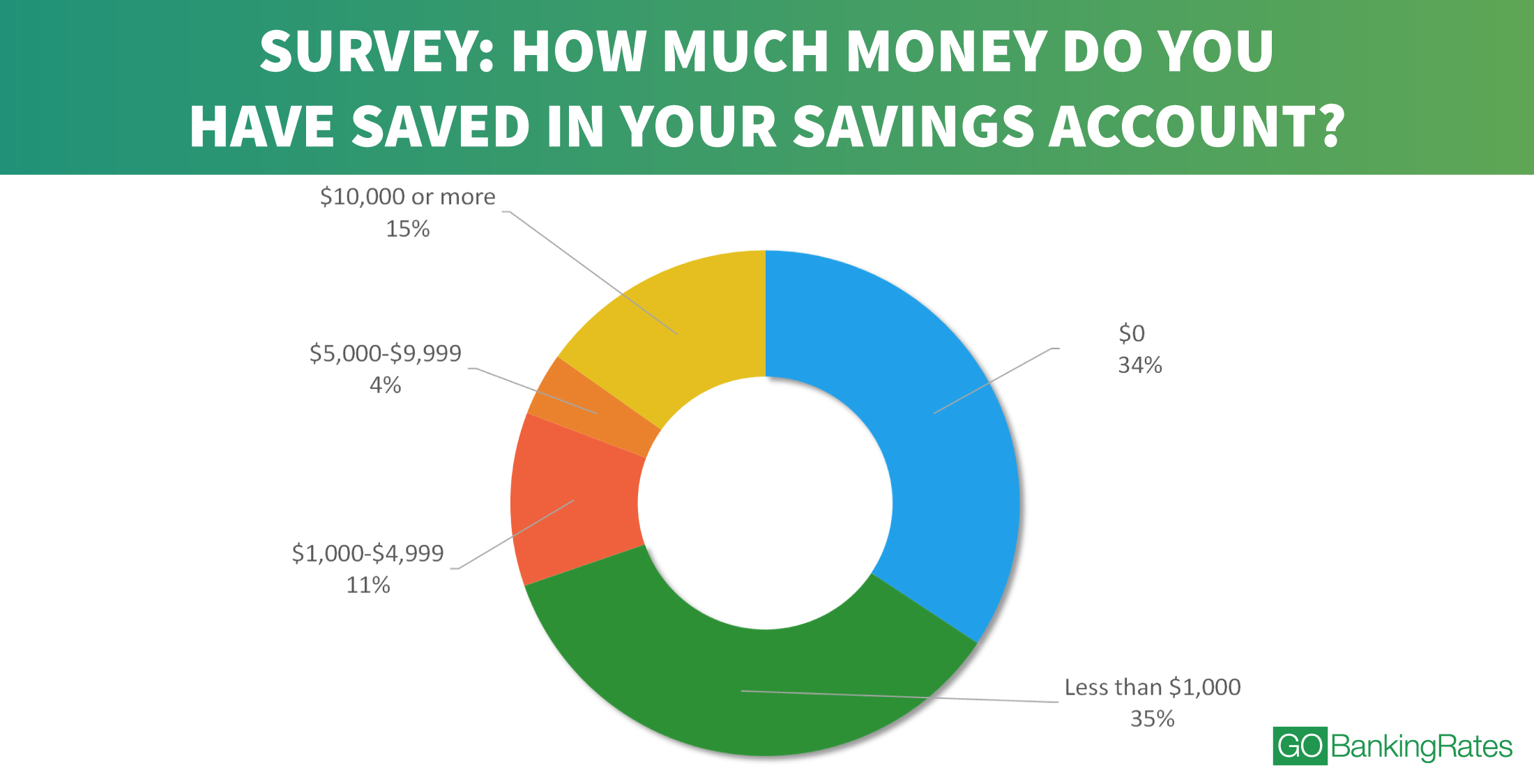

Recently, GOBankingRates asked the question again, this time to more than 7,000 people to see if Americans’ saving rates have improved in the last year or so. But the results are even more surprising — the percentage of Americans with less than $1,000 in savings has jumped to 69 percent.

That’s up from 62% the last time GOBankingRates asked last year. Even worse, 34% of those surveyed say they have $0 in their savings. Zero! Nothing! Zilch! Nada!

This is really bad news, folks.

Here’s the visual breakdown of how much those surveyed have saved.

So what’s causing the lack of savings? It could be simple overspending, or a lack of attention to saving, or the need to dip into savings thanks to jobless or other financial burdens.

GOBankingRates doesn’t specifically ask why respondents have as much (or as little) as they do, but they do point out millennials spending habits and a need to keep up with the joneses, as it were.

A survey by TD Ameritrade found more than nine in 10 millennials overspend, fall short on savings or take on additional debt at least once a month per year. One reason could be because they feel pressured to develop certain spending habits. For example, the survey found 52 percent of millennials feel pressure to keep up with their friends due to always going out, and 46 percent feel the pressure because of social media posts.

It’s the first I’ve seen research that specifically blames social media for a lack of savings, but it makes sense — it’s easier than ever to see other people going out, having fun and spending money, driving you to do the same.

Not surprisingly, the lower your income, the more you struggle to save. According to the survey, more than two-thirds of respondents making less than $50,000 per year have less than $1,000 saved (including none at all).

Obviously, it’s pretty discouraging to see such low savings amounts. There’s clearly a lot of information that we don’t know — how many of these people are in significant debt? what type of circumstances lead to the lack of savings? — but it shows a real need to encourage and promote saving money.