I can never get tired talking about how much better index funds are than actively managed funds.

There’s so much proof that shows that you can’t effectively time the market or pick stocks, but as time goes on, the evidence just continues to mount.

There’s new research out that shows just how bad it is for actively managed funds.

And it’s bad.

The SPIVA Scorecard, published by S&P Dow Jones Indices, “compares actively managed funds against their appropriate benchmarks on a semiannual basis.”

It’s an in-depth report that looks at actively managed funds and compares them to the right index for their class and type to see how well they’ve performed over time. The scorecard is incredibly in-depth, with data accounting for:

- Survivorship bias (including closed or merged funds in the comparison)

- Correct index comparisons (comparing the fund to the right size index, not simply the S&P 500)

- Asset-weighted returns (showing both equal- and asset-weighted averages)

- Category drift (whether a fund stays invested in a particular categorization or drifts over time)

(I encourage you to read through the SPIVA website when you have a minute.)

Here’s How Bad it Was for Actively Managed Funds

The SPIVA scorecard (pdf) for the year ending 2016 looked at the last 15 years of returns, and broke down one-year, five-year, and 15-year comparisons.

- During the one-year period ending Dec. 31, 2016, 66% of large-cap managers, 89.37% of mid-cap managers, and 85.54% of small-cap managers underperformed the S&P 500, the S&P MidCap 400, and the S&P SmallCap 600, respectively

- During the five-year period ending Dec. 31, 2016, 88.3% of large-cap managers, 89.95% of midcap managers, and 96.57% of small-cap managers underperformed their respective benchmarks.

- Over the 15-year period ending Dec. 2016, 92.15% of large-cap, 95.4% of mid-cap, and 93.21% of small-cap managers trailed their respective benchmarks.

92%!

Can you believe that? 92 percent!!!

More than 9 out of 10 large-cap actively managed funds trailed the S&P 500 index.

It’s unreal that people would ever think it’s worth investing in actively managed funds. It is just not worth it.

You literally have less than a 1 in 10 chance of making more money with an actively managed fund than you do with an index fund.

And it’s not just in large-cap funds (which we’ll use for the easy S&P 500 comparison). It’s even worse in mid-cap and small-cap funds!

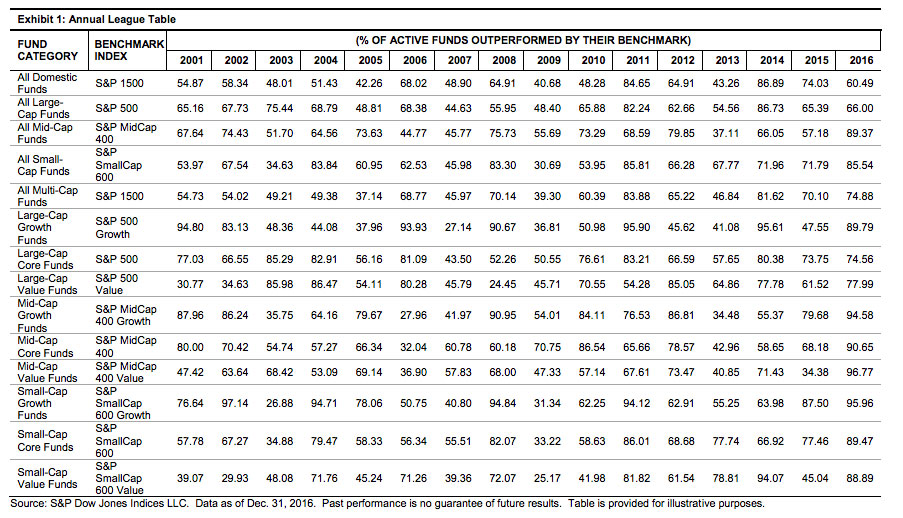

Take a look at this chart that shows year-by-year comparisons between fund categories and their benchmark index — and how many active funds were outperformed by their index.

There’s a few outliers in there, but generally you’re seeing more than 60, 70, 80 percent of active funds trailing their benchmark. (These comparisons are net of fees.)

It’s crazy.

There’s just no reason to invest in actively managed funds, unless you want to pay someone to make bad decisions for your money.

Photo by Mitch Nielsen on Unsplash