Professional athletes tend to make a lot — and often lose a lot — of money.

For many, it’s because they come into it quickly. They may not have ever had much to begin with. Others make poor investments. And others blow it all, then have the IRS on their tails.

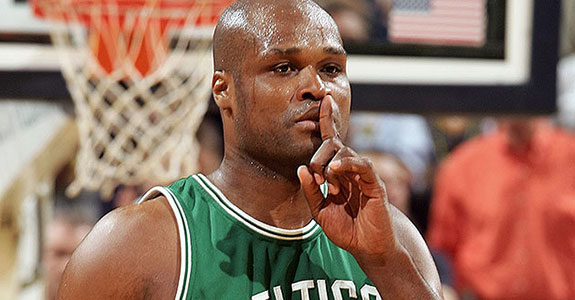

For Antoine Walker, the former Boston Celtics star, his rise and fall — including losing almost all of his nearly $110 million earnings from the NBA, is incredibly painful.

Yahoo! Finance has the story, including a pretty dramatic video (that won’t embed here for some reason).

It’s a sad story, indeed. If there’s any positive, it’s the lessons learned that, hopefully, some new superstar will take to heart.

Looking back, Walker says he regrets making significant investing decisions before retiring from the league. With his attention focused on his NBA career — in full swing at the time — he didn’t have time to keep a close eye on his investment properties, and like many others, was caught off-guard by real estate crash.

“I think there were different ways of how I could have saved the bulk of my wealth. I could have been on top of it. I missed a lot of court dates, a lot of default judgments, there’s a lot of properties I could have kept that I thought were good investments,” Walker said.

Hitting rock bottom in 2010, Walker declared bankruptcy, citing $12.74 million in liabilities with $4.28 million in assets. The entire bankruptcy process was drawn out over two years. Stripped of his credit cards and his bank accounts frozen, it was heartbreaking for Walker to liquidate many of his priceless possessions, including his NBA championship ring his team, Miami Heat, won in 2006.

Sharing his story hurts, but Walker is doing even more — including releasing a documentary about his financial failings, Gone in an Instant, next year.

It includes this bit of advice for incoming NBA stars: “Get the word ‘No’ in your vocabulary. You’re going to have to say no to a lot of people that are very important to you. Stick to your financial plan and don’t invest until you’re done with your career when you’re able to be hands-on.”