Everyone loves to hate Bank of America — myself included.

I certainly don’t feel bad about it (especially when you see things like this), but as one of the country’s giant banks, they can clearly influence the way the market goes — from the negatives like fees to the positives like technology.

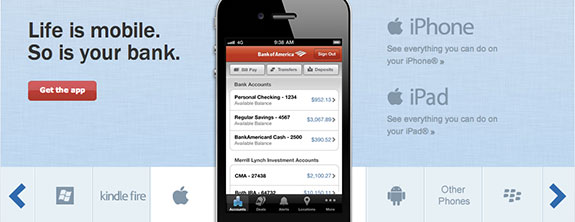

So as banking goes more and more mobile, Bank of America is obviously at the forefront of that trend. David Godsman, an executive at the Charlotte-based bank, recently participated in a Q&A with CharlotteObserver.com about their mobile banking strategy.

Here are some of the highlights.

Q. What is Bank of America learning about customers who use mobile banking?

A. Convenience, accessibility, the anytime-anywhere ability to bank is critical for customers. Our (mobile) customers are growing at about a rate of 195,000 per month. The drivers behind that are a lot of the core (banking) services that we know customers want to take advantage of. They’re depositing 175,000 checks a day. We’re seeing them transfer (money between accounts or by making payments from accounts) 4.5 million times a week.

Q. What’s coming next in the mobile banking industry?

A. You will see geo-location potentially come forward: Let’s say that mobile banking is available in your automobile and you’re trying to find the closest ATM or (branch) … as you’re running errands. Or you’re walking through the streets of New York and you look at your mobile banking app to find the most convenient (branch) within a five-block radius.

The biggest advancement you also may or may not see will be in the security side. With biometrics coming to market … (it) enables many institutions to take advantage of some of those capabilities in a much more productive way for customers to enable them to navigate in and out of their applications with the same level of, if not more, security.