I hope you’ll let me get on my soapbox for a bit, because I have a gripe to complain about.

OK – it’s not really a huge complaint – but it’s definitely one of those annoying things that I can’t be the only person who gets annoyed about.

It’s the chip.

You know what I’m talking about.

You go to buy something at a store, you pull out your debit card, and before you go to swipe, you have to figure out if you:

- swipe the card in the card reader

- insert the card into the chip reader

- ask the cashier (if there is one) what you’re supposed to do

If it’s a store you’ve been to enough, you probably know what you need to do. But if it’s a place you’re going to for the first time or don’t visit that often, inevitably you’re going to do the wrong thing.

And … it’s annoying.

Before I soapbox more, let’s talk about what the chip is first.

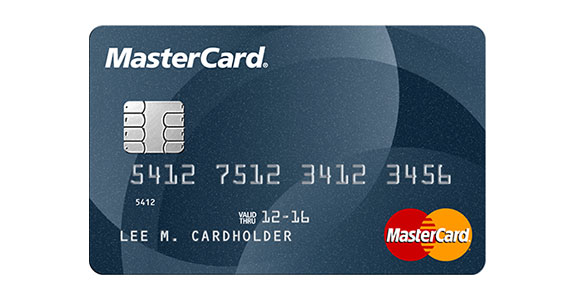

The EMV Chip Standard Promises Secure Transactions

Money guru Dave Ramsey has a great outline of chip cards on his website. Here’s a snippet:

The card’s microchip creates a unique one-time-use code for each transaction. This makes the cards more difficult to counterfeit and makes them useless for onsite retail purchases if someone steals your card without knowing your PIN. It also prevents hackers from getting your account number in the event of a store’s data breach.

Essentially, chips replace the magnetic stripe on the back of your card to make the transaction more secure.

It’s a standard that has been used in Europe for years, hence the official name of the cards — EMV, which stands for Europay, Mastercard, and Visa, the three companies that created it.

Obviously, however, not every retailer has transitioned to chip cards, so all of our debit cards have both the chip and the stripe.

This leads us to our “what we do” every time we go to purchase something at the store.

The confusion really stems from the fact that we’re in the middle of this transition to all chip cards. It’s clearly not the worst thing in the world, but it’s definitely confusing.

According to Bloomberg, as of last September, only a third of US merchants accept chip cards … a year after the official switch from the magnetic stripe.

I’ve seen stores with chip reader technology but signs that say “no chip, just swipe” — meaning the chip technology isn’t even turned on (as it were). And every time I go to CVS and use their chip reader, I’m subject to the loudest, most annoying sound ever to let me know I can take my card back.

Obviously, the goal of making our transactions more secure and less prone to breaches like we’ve seen at retailers like Target and Home Depot is an important one. But it certainly hasn’t been easy.

(By the way, Bankrate has a funny set of GIFs on how to insert your chip card into a reader … if you have no idea how to do to that.)