Do you have a job?

Does your employer offer a 401(k) or other retirement savings plan with a company match?

Are you eligible for other employee benefits, like tuition discounts, profit sharing or loan contributions?

If you said yes, you need to make sure you’re getting all the free money from your employer that you possibly can.

First off: everyone’s job is a bit different. So obviously the examples in this post may not apply to you.

But there’s a good chance that some of it is applicable, and if it’s not the specific examples, then it’s the general theory.

Employee benefits are some of the biggest differentiators employers can have to recruit and maintain talented employees; some may even argue that benefits are more important than salary to employees. I don’t know that I agree with that, but surely the benefits package has a huge impact on whether or not the job is worth taking.

Most employee benefits center around insurance (health, dental, life) and time off (whether it’s sick time, vacation days or some combination thereof).

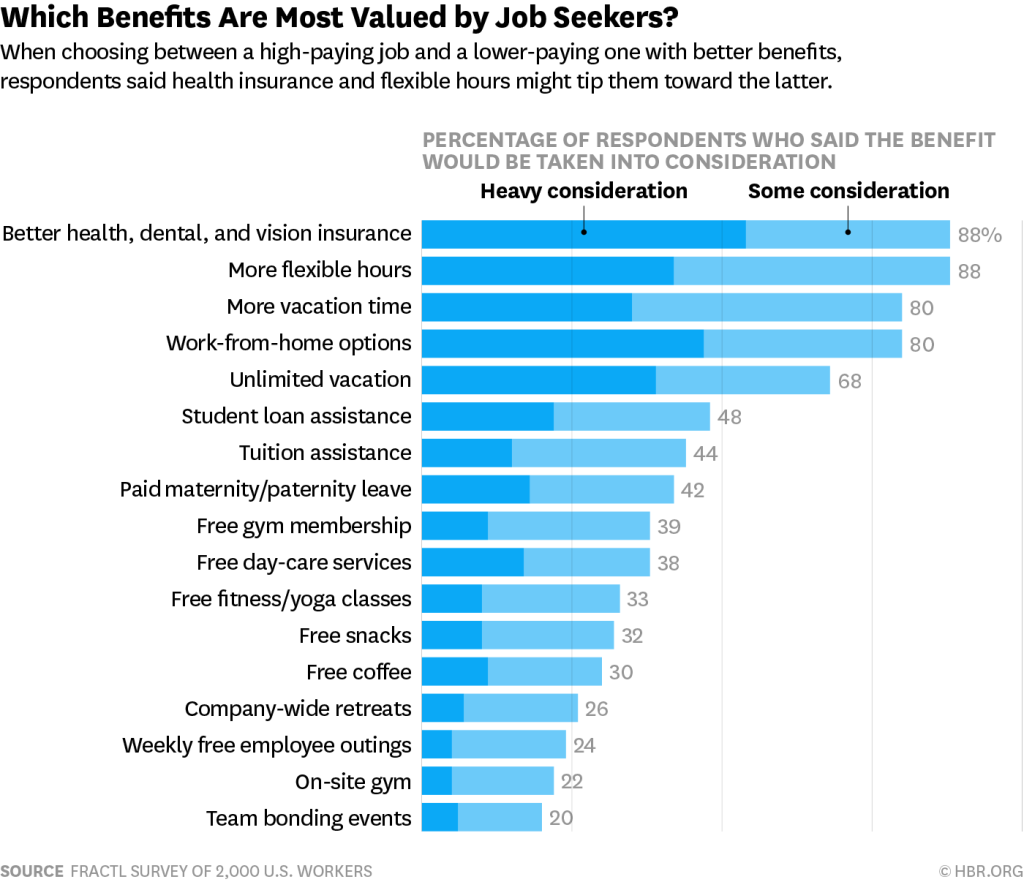

According to the Harvard Business Review, the most desirable benefits for job seekers are insurance, flexible hours, vacation time and ability to work from home.

It’s not totally surprising that health insurance is most desirable, given the current discussion around insurance in Washington, D.C. But as you can see, there are a lot of creative benefits that people look for, from free coffee and snacks to a gym membership to student loan assistance.

(This survey doesn’t seem to consider retirement matching as a benefit, but it surely is.)

Starbucks, which has 254,000 employees, has always been known for its extensive benefits packages — even for part-time employees. They even cover tuition at Arizona State University through their College Achievement Plan.

If you have a job that offers benefits, take advantage of them.

It’s like getting books from the library; you’re paying for it, so use it.

If your employer offers an employer match for your retirement savings, you absolutely need to enroll today. It’s literally free money that you are owed.

It doesn’t matter if you can’t invest a ton of money; invest just enough so that you get the full match or contribution from your job. If you’re even luckier, your employer has automatic enrollment set up, so you can’t put off signing up.

In some cases, your employer is required to offer either a match or a nonelective contribution in order to maintain their retirement program.

Take it! Use it! Don’t waste it!

Benefits are Part of Your Compensation: Use Them!

When you work at a business, the employer doesn’t just consider your salary as your total cost to the business. The money that gets direct deposited into your bank account may be the most important number to you, but your employer has a bigger number, which includes:

- your salary

- your employer’s share of your tax bill

- your physical overhead (tools, uniform, computer, office space, etc.)

- your benefits (insurance, time off, retirement match, etc)

So even if you get paid $50,000 a year, your cost to your employer is well more than that. (Here’s a good infographic that breaks it down with some examples.)

Assuming you work for a well-run business, those additional costs are budgeted to be spent by you, the employee.

Benefits aren’t bonuses that you get because you did a good job at work this year; they’re part of your overall compensation package. If you don’t use them, they’ve gone to waste.