I was asked on Quora to answer a question about hedging against losses …

How can one hedge against a significant loss in Vanguard’s Total Stock market Index Fund?

Unfortunately, there wasn’t a ton of information included in the question with specifics on what scenarios the asker was referring to, but I took a leap in answering any way.

Hedging Against Stock Market Losses

I agree with Stephen Lee’s response that this isn’t exactly the soundest strategy, but perhaps I can work toward what you’re asking.

Let’s say, for example, that you’re nearing retirement, and you want to make sure your investments are more conservative so you’re not hit with a huge loss should the stock market take a tumble right before you’re ready to tap into your savings.

If that’s the case, then you want to ensure you have proper asset allocation.

Asset allocation (according to Investopedia) “aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance and investment horizon.”

Essentially, your investments should include funds not in the stock market.

Even though buying an index fund like Vanguard’s Total Stock Market ensures you are investing in a diversity of companies, the reality is is that the stock market does go through periods of decline — and you don’t want that to happen right before you need money from your investments.

If you want to hedge against losses in the stock market, then invest in bonds.

Vanguard offers the popular Total Bond Market Index Fund (VBMFX), which is designed to be a conservative investment that offers stability.

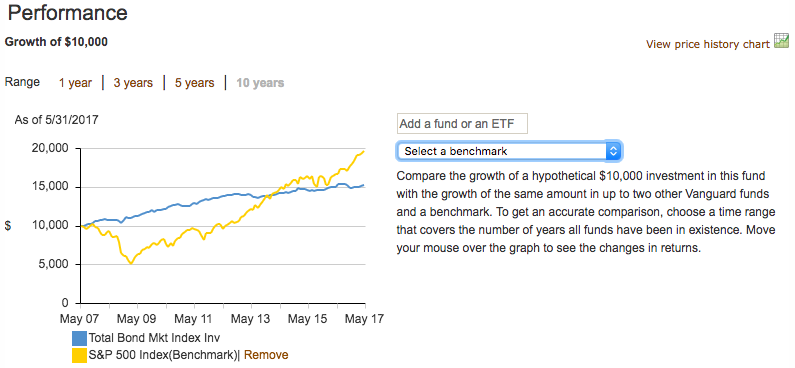

Here’s how VBMFX has grown a $10,000 investment over the past 10 years, with the S&P 500 as a benchmark.

Bond index funds provide stability when you’re looking to reduce your investment risk.

Of course, if you are early on in your retirement savings journey, you have more tolerance for risk (and need for it). So you should invest more in stock funds (like the Total Stock Market) and less in bond funds while you are younger, slowly shifting your asset allocation more towards bond funds as you age.

There’s a popular way to figure out how much bonds you should own.

John Bogle, who founded Vanguard, says that the percentage of bonds in your portfolio should equal your age. So if you’re 35, bonds should be 35% of your portfolio and stocks 65%.

It’s a rule of thumb — not a hard and fast rule — so I’ve seen folks suggest stocks at 110 or 120 minus your age (120–35 = 85% stocks). (Read more about it here)

It comes down to how risky you feel, and how long you expect to work until you need the funds.

Photo by Chris Liverani ↠ on Unsplash