Here’s something that’s a bit funny. The easier it gets for folks to do their banking online, the more who like to go into branches to do business.

That’s according to a recent survey by the American Bankers Association (ABA), which looked at how Americans like to do their banking in 2014.

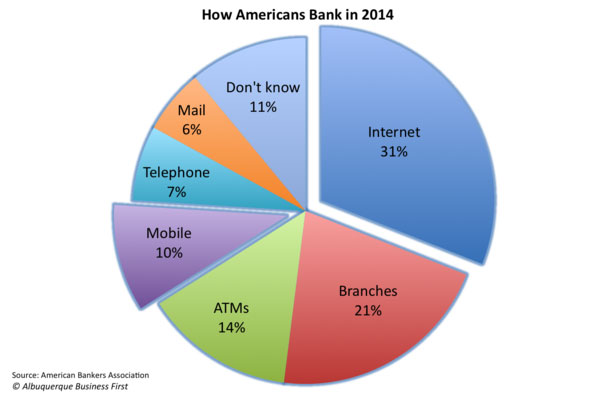

Banking online is still the most popular method, with 31% of respondents saying it’s the most-used method to manage their accounts. That’s down from 39% in 2013. It’s the sixth straight year that banking online has been the most popular way to bank, but both new and old methods are starting to grow.

Mobile banking, which includes smartphone and tablet usage, grew from 8% in 2013 to 10% in 2014. But surprisingly (or maybe not), in-branch banking rose to 21% (from 18%) and ATM usage rose to 14%.

Here’s the breakdown of how Americans bank, courtesy of Albuquerque Business First.

So why the increase in in-person banking? There’s a few potential reasons.

Maybe people just want some human contact — something your smartphone or computer can’t really give you. Or perhaps they’re doing something more complex than managing their money and paying bills, says Nessa Feddis, ABA’s senior vice president and deputy chief counsel for Consumer Protection and Payments.

“It’s clear that branches are still popular with many bank customers,” said Feddis. “When people are conducting a complex transaction like opening an account or applying for a home or business loan, they often prefer to do it in person. We’re seeing a branch renaissance in some areas, with many banks transforming their branches to become more efficient and customer-friendly.”

Online banking has been the most popular way to bank since 2009, going from 25% of respondents naming it their favorite way to bank until it hit 39% in 2013.

What’s your favorite way to bank? Leave a comment and let us know.