With the rise in popularity of sites like Kiva, microlending and microloans have become buzzwords in the personal finance, lending and investing industries.

But what exactly does it mean to make or accept a microloan?

In purely banking terms, a microloan is a loan of up to about $50,000. Usually, the microloan is for a small business or entrepreneur looking to get off the ground or expand their current business. Oftentimes, microloans are given to those in impoverished or “underbanked” countries, where getting a traditional loan isn’t easy.

History of the Microloan

Microloans, or microcredit, can be traced back to the 18th and 19th centuries. According to Wikipedia:

Jonathan Swift inspired the Irish Loan Funds of the 18th and 19th centuries. In the mid-19th century, Individualist anarchist Lysander Spooner wrote about the benefits of numerous small loans for entrepreneurial activities to the poor as a way to alleviate poverty. At about the same time, but independently to Spooner, Friedrich Wilhelm Raiffeisen founded the first cooperative lending banks to support farmers in rural Germany.

Modern microlending was kickstarted in Bangladesh by the Grameen Bank, where founder Muhuammed Yunus would use his own money to lend small amounts of money to poor borrowers. The idea spread throughout the world, and Yunus actually received the Nobel Peace Prize in 2006 for his microlending revolution.

In the United States, the U.S. Small Business Administration (SBA) helps connect small business owners with microlenders through its Microloan Program. On average, the SBA says the microloans it helps facilitate are about $13,000.

The are some rules for how microloans through the SBA can be used. They can only be used for working capital, inventory or supplies, furniture or fixtures, and machinery or equipment. They can’t be used to pay existing debts or purchase real estate.

Generally, interest rates are between 8 and 13 percent, and the maximum allows repayment term is 6 years.

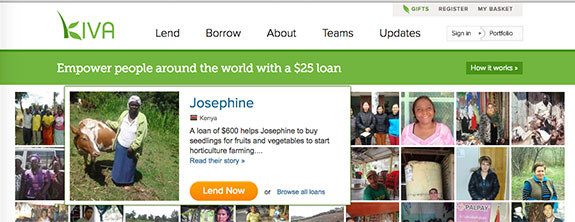

Microlending Through Kiva

Sites like Kiva allow groups of people to make microloans to established and new businesses throughout the world, with dual goals of getting a return on their investment and — more importantly — helping the borrower to grow their business or get it off the ground.

Because microloans are not huge dollar amounts, it’s easier than ever for you or I to get involved, make some money on our investments, and help those who need a boost by investing in them.

While I haven’t yet done any microlending, it’s certainly something I’m considering. The default rate is only 1.3%, and with interest rates averaging 35% — that’s something you can’t even touch in a mutual fund.

Microlending is available to lenders and borrowers in many countries throughout the world, from Grameen Bank in Bangladesh and Banco Occidental de Descuento in Venezuela to options in Sweden and China.