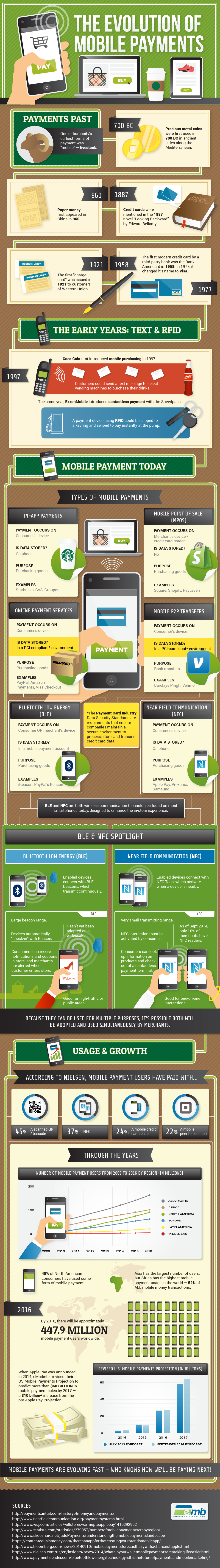

According to Nielsen, mobile payment users are engaged in a diversity of mobile payment methods. In 2014, mobile users paid with a scanned QR/barcode (45%), NFC (37%), mobile credit card reader (24%), and mobile peer-to-peer (22%). The variety of ways that consumers pay with mobile seems to be a reflection of the times. Right now small and large businesses are racing and researching to discover how best to get individuals to pay with their mobile devices, which has resulted in the birth of a variety of payment methods and systems that promise to make shopping and bill pay more convenient, effective, and safe.

With all the choices out there, industry watchers are wondering if consumers will ever grab onto a mobile payment method in the near future. Or if a creative tech company will create the ultimate mobile payment system that will give consumers the security and convenience they need, and will bring retailers and card makers to some sort of consensus on payments technology. Here is a quick look at the leading mobile payment methods so far.

QR Code and NFC

QR codes enable users to scan, store, and share code scans. This contactless payment solution that lets people and businesses to make payments with mobile phones. Individuals can store consumer banking information into phones that activate when QR codes are scanned for payment. So instead of carrying around stacks of cards, consumers can pin an item, scan barcodes and check out.

Near Field Communications (NFC) is the technology that drives Apple Pay. This contactless transmits a short range frequency transfers small amounts of data retail terminals and smartphones. The smartphone relays user encrypted bank account information to a specific terminal that processes payment.

Mobile Credit Card Readers and Mobile Peer-to-Peer

Mobile credit card readers are especially popular with business owners. These attachments basically turn smartphones into credit card machines that enable business to accept plastic. Some of the most common readers are the Square, Intuit GoPayment, and MagTek iDynamo.

Peer-to-peer payment apps allow friends to send money to each other’s bank accounts using their cell phones. This is perfect for occasions like splitting bills with roommates, buying concert tickets, splitting the bill at a café, etc. No longer will consumers have to use wire transfers, wait for bank to bank transfers, or get frustrated while waiting on friends to pay them back.

As the mobile payment process evolves, companies and consumers will be watching for the best and most safe ways to make payments with mobile technologies. While these mentioned methods are the most prominent now, the unpredictability of the market could produce a sweeping new technology that consumers flock to. Regardless of which technologies consumers prefer, small businesses need competent payment processors like eMerchantBroker.com that can process any type of mobile payment technology. The future is now, team up with a trusted payment processor who can help grow your business no matter the trend.