I tell this story all the time, and I’m sure I’ve written about it here, too, but I can’t seem to find a post about it. When I opened up my first online savings account way back in 2006 with ING Direct, it was a good time to be saving. Interest rates were well above 4% — many in the mid-5% range as well.

So I remember fondly logging into my ING Direct account in the morning at work, seeing how much money was in my account and how much interest I had earned from it being there, and then checking it again before the end of the day, and seeing the interest earned even higher — in just a few hours.

Sure, it was only a few pennies most days (especially toward the beginning of my savings journey), but I got hooked on watching that number grow. The more interest I earned, the higher my net worth, and the closer I got to my savings goals. So I fed it as much money as I could … and it was great.

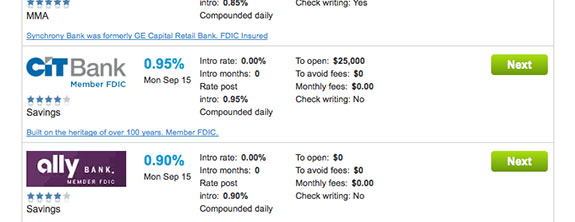

Of course, that was before the economy crashed, and interest rates fell through the floor. We haven’t seen anything even close to 2% in years — and if you get over 1%, you’re pretty luck. Here’s the current rates from BankRate to prove it.

Even with more money in the bank than when I started, the interest earned moves much slower than it previously did (thanks to the ridiculously low rates), so the fun isn’t there anymore.

But — and here’s the good news — interest rates may be going up for online savings accounts, says DepositAccounts.com.

It’s too early to call it a trend, but it’s a noteworthy change. The average rate of internet savings and money market accounts had the largest increase this year. It went up by more than 3% from 0.605% to 0.627% from August to September. This increase was primarily driven by large rate increases at three banks: Palladian Private Bank, Citizens State Bank and ableBanking. All three of these banks now have online savings accounts that are rate leaders.

DepositAccounts says the increases may be due to the increased need for deposits, so banks can lend out the money. That’s good news for savers, especially since we’ve had to deal with incredibly low rates for the past 6 or 7 years.

We’ll stay tuned to the rates and see if it’s a real trend or just a momentary spike — hopefully for us savers, it’s the former.

(If you’re interested, one of our favorite financial media sources, Kiplinger’s, has a slideshow on the best ways to earn more interest on your savings).