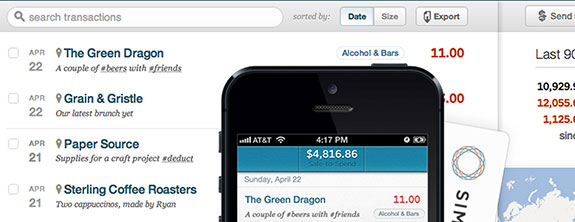

I’m not that familiar with Simple, the online bank that promises built-in budgeting and savings tools, no unnecessary fees and everything you need to make managing your personal finances “effortless.”

Even though it’s affiliated with The Bancorp Bank, where users’ money is actually held, Simple is a startup company — and it’s seen its share of growing pains.

TechCrunch has the whole story:

Nearly two months after an upgrade to its systems and infrastructure, online banking service Simple is still recovering from a series of glitches that have affected every aspect of money management from bill payments to being able to see a correct available balance to refund delays, credits appearing as debits, and much more.

The problem became so bad that Simple began crediting its angriest customers $50 to make up for the problems, which The Oregonian determined equalled roughly $600,000 in payouts.

While the vast majority of Simple’s issues – like card downtime – were resolved within the 24-hour maintenance period, some customers (like myself) continued to have problems.

Not good. As TechCrunch notes, most of the time early adopters of products — especially from startups — are used to being guinea pigs, or at least dealing with unforeseen problems.

But there’s a difference when it comes to banking and money management products. No one wants to worry about the chance of losing money, being misinformed about how much money they have in their account, or if a bill they thought they paid actually got paid.

And this is why it’s incredibly hard to be a banking startup.

For every Mint.com, where everything seems to go right and — even though there are concerns about security — there are no actual problems, there’s plenty of other startups that not only fail, but cause plenty of financial headaches for consumers along the way.

But, like in good startup fashion, Simple was still acquired for $117 million earlier this year.

Hopefully they’ll be able to turn it around and fix the problems – for the sake of their users.