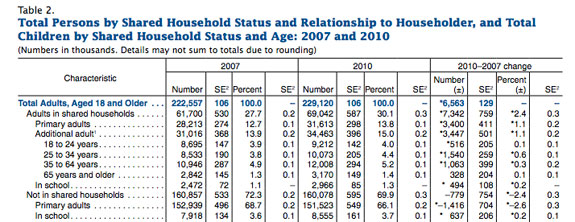

Millions of Americans cushioned themselves against the 2009-10 recession by doubling up in houses and apartments, according to the U. S. Census Bureau in a report released June 20, 2012. The number of adults sharing a household with family members or other individuals jumped from 17 to 18.7 percent of households from 2007 and 2010. Doubling up accounted for 22 million of 2010 households.

If logic services me, doubling up guarantees one household could be at least two, or that 22 million households could be at least 44 million households. The report cited young adults as the most likely to be part of a doubled up household, so that families with several children could be three or more households. Some undoubtedly share a household by choice, but the lack of job opportunities, low wages and high taxes on wage income depress opportunities to start new households.

Too often, the popular media treats inequality as a matter of fairness, but these tiresome equity debates have turned into an indulgence America can no longer afford. America’s growing inequality depresses buying power and eliminates billions of dollars in transactions that would support production, income and jobs.

College graduates returning home to live with parents and find part time and temporary jobs limit billions of dollars that should be going into the spending stream for housing, along with home furnishings, apartment and homeowners insurance, clothing and consumer goods sales, which in turn cut the income of landlords, realtors, department stores, insurance agents, which in turn cuts tax revenues and spending for all levels of government, and so on.

The Bureau of Labor Statistics occupational employment data tells some of the inequality story. In 2009, I can find 199 occupations that employed 57.6 million people working in jobs that paid median wages less than $30,000. By 2011, those same 199 occupations employed 56.7 million people and 40 of the occupations had lower wages in 2011 than 2009; another 126 had some increase in wages but less than the rate of inflation.

Cashier was one of the 33 remaining occupations with 2011 wages high enough to raise the buying power of cashiers, but the higher median for 2011 was still only $18,820.

Millions who work and live on wages have to double up on housing and do without health care and other necessities. The Obama administration’s social security tax cut generated a broad based increase in buying power that primarily explains the modest boost to the economy. In spite of the improvements, the well-to-do keep defending policies like low tax rates on dividends and capital gains, knowing full well that people living on wages pay higher taxes to make up the lost revenue.

I do not hear Democrats or Republicans willing to confront inequality as self defeating policy for all, but that is what it is now. Unless the inequality issue is addressed, the economy and job markets will continue to flounder indefinitely. Take that as a forecast.

About the author: Fred Siegmund covers America's jobs as part of work doing labor market analysis and projections for a client base of recruiters, trainers and counselors. Visit him at www.americanjobmarket.blogspot.com

About the author: Fred Siegmund covers America's jobs as part of work doing labor market analysis and projections for a client base of recruiters, trainers and counselors. Visit him at www.americanjobmarket.blogspot.com